Market trends

on

Skin care

KEYWORDS

Health and beauty,

Premiumisation and affordability,

Wellness,

Consumer Trends.

peer-reviewed

Top four trends shaping the beauty and personal care industry in 2024§

KAYLA VILLENA1, EMILIE HOOD2

1. Head of Beauty and Personal Care, Euromonitor International

2. Consultant Beauty and Consumer Health, Euromonitor International

ABSTRACT: This article explores the key trends currently shaping the beauty and personal care industry, driven by evolving consumer preferences, technological advancements, and increasing demand for sustainability. As beauty consumers redefine "value," brands must balance premiumisation with affordability, focusing on both quality and price.

The beauty and personal care industry outperformed expectations for 2023. Euromonitor International, data analytics company, takes a look at the four key trends adding value for consumers, driving growth in this sector.

Source: Euromonitor International

Premiumisation and affordability: Deliberate purchasing approach is shifting the consumer journey to redefine “value”

While global inflation moderated in 2023, Consumer are adopting a more deliberate purchasing approach, realising that they need to make the most of their reduced disposable income, limited by elevated prices in necessities. Strict budgets are more common due to high cost of living, however this isn’t equating to reduced consumption. Rather, beauty consumers are trading down in some categories to afford premium options in others

In 2024 consumers are adopting behaviours to maximise value from BPC purchases, such as seeking discounts and promotions, utilising rewards points, leveraging social media to uncover deals, and subscribing to “deinfluencers” who expose over-hyped products. Rather than simply cutting spending, they seek out dupes—competitively-priced products with perceived benefits comparable to higher-priced items—which has evolved into signal of savvy, rather than a source of shame, particularly among Generation Z who lack the purchasing power of older generations.

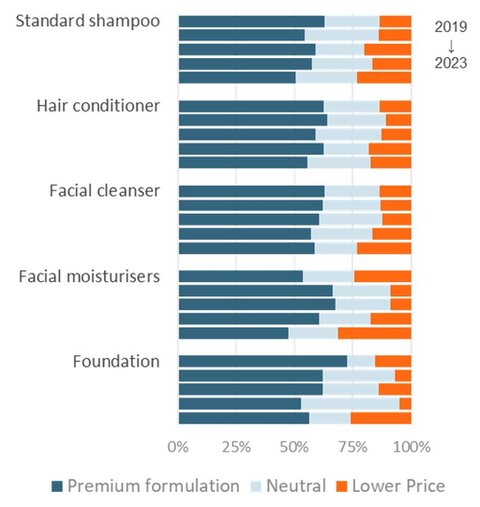

Trade-offs: Premium formulation vs Lower Price, China, 2019-2023

% of Beauty and Personal Care Respondents in China, 2019-2023

Source: Euromonitor Voice of the Consumer: Beauty Survey, fielded June-July 2023

In some markets, price is becoming an increasingly important factor as consumers evaluate trade-offs. The percent of beauty consumers in China who looked for “lower price” instead of “premium formulations” jumped in 2023 across categories—a trend we expect to continue as China experiences deflation and consumers look for premium formulations at lower prices.

Ingredient-led beauty: Ingredient-specific claims have potential to ask for higher prices than general descriptions

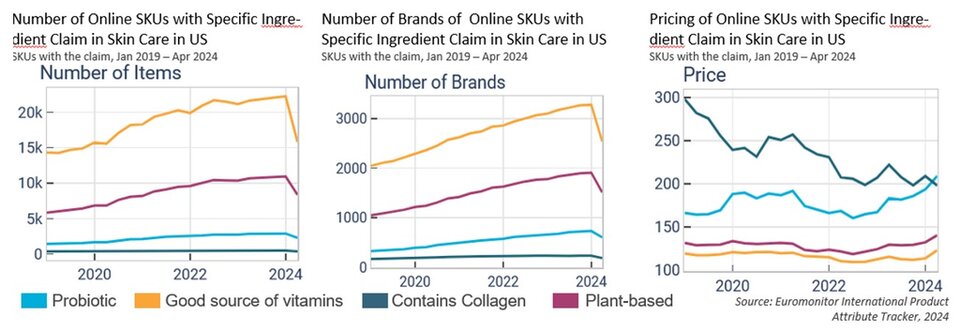

At its core, the ingredient-led beauty trend highlights the benefits of specific ingredients and empowers consumers to seek out actives to treat or prevent beauty concerns. As consumers grow increasingly wary of brands the trend is developing a sustainability focus, looking to understand “greenwashing” natural ingredient claims, to better understand which claims have scientific consensus.

“Probiotic” and “collagen” were first popularized in the supplement and food space before migrating to skin care. In the US, for example, they rose to popularity in facial care, specifically moisturisers and anti-agers, before extending to other categories. Although there are fewer Stock Keeping Units (SKUs) in the US with those ingredients, they command higher prices compared to more general claims. This is a key takeaway for beauty brands who target ingredient-savvy consumers, willing to pay a premium for specific ingredients, rather than relying on general claims.

Blurring Wellness: Wellness and safety trends boost sun care’s transition into an everyday product with skin health benefits

Historically, sun care was primarily designed to shield against UV rays and avoid sunburn, consumers are looking for products that provide skin care benefits as well as protection.

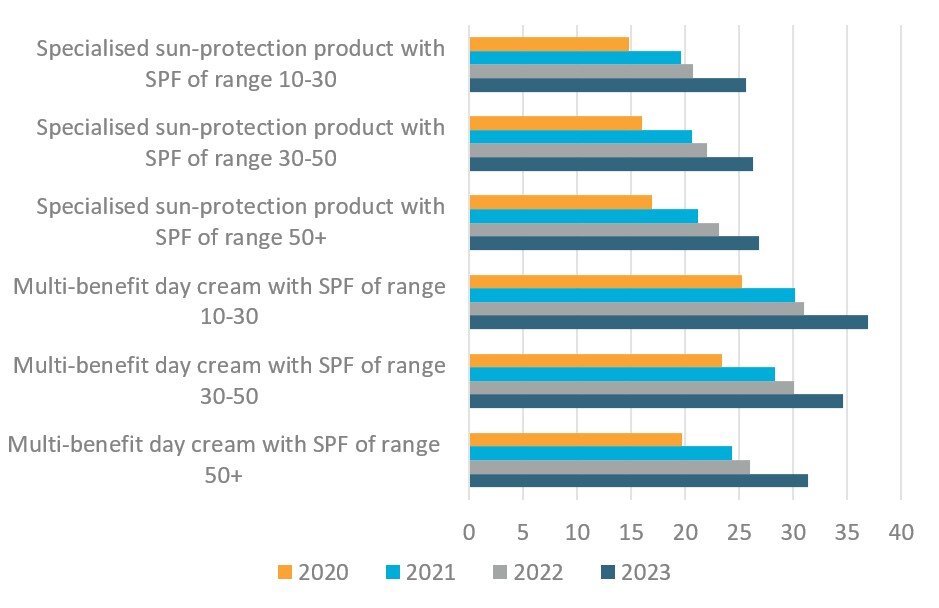

What kind of sun protection do you typically use on a weekly or regular basis?

% of global respondents, 2020-2023

Source: Euromonitor Voice of the Consumer: Beauty Survey, fielded June-July 2023.

Ongoing education efforts from the health and beauty industry have successfully changed consumers' views on sun care, as they increasingly use sun protection year-round, rather than just during specific seasons. About a third (34%) of global consumers used a multi-benefit day cream with SPF on a weekly or regular basis, while a quarter (26%) used a specialized sun protection product in 2023—up from 23% and 16%, respectively, in 2020.

Indonesian company Luxcrime debuted Ultra Fine Sunscreen Spray SPF 50 PA+++ at the end of 2023, which is formulated with aloe vera, green tea extract and niacinamide. 33% of Indonesian consumers actively sought out sun protection products that improve texture and even skin tone in 2023—much higher than the global consumer figure of 13%. This is part of a larger trend of invisible sunscreens that can take the place of other skin care or colour products.

Transforming women’s health: Higher demand for products designed for women’s life stages creates opportunities in hair thinning/loss/growth

The past decade has seen a push among female consumers to better understand how hormonal changes during life stages impact skin and hair. From 2019 to 2023, the percentage of female respondents seeking skin care suitable to hormonal fluctuations increased among all age groups.

Consumer awareness of hormones’ impact is higher in skin care than in hair care, due to the success of public health initiatives, high-profile research studies, and well-known skin care brands. However, interest is growing in specialised hair care. Products like Germany-based Plantur 39 Phyto-Caffeine Made For You 3-Step System are useful for any consumer experience dry brittle hair,

with the brand choosing to focus its communication around women’s wellness, cementing its position as being “for women experiencing thinning hair due to menopause.”

Predictions for 2024 and 2025

Premiumisation and affordability will continue to be a balancing act between consumers need for quality and price. While inflation normalises, consumer pricing sensitivity will remain, resulting in consumers continuation of altered habits. Longer-term, consumers looking for specific brands or SKUs are likely increased volume per transactions when products are on offer.

Consumers are looking to ingredients to make the most out of their beauty purchases. Beauty brands should consider a portfolio has a range of formulas—enabling the consumer tailor their routines for different occasions and results. Longer-term, biotechnology innovation will play a much larger role in ingredient sourcing.

“Longevity” will become the updated term for wellness, as consumers want to look and feel their best for as long as possible. Beauty brands catering to younger consumers should emphasise preventative solutions, while brands catering to any age group may consider category-extensions across categories and beauty products, vitamins/supplements, foods to support a healthy diet and mental wellness.

The foundation for women’s health will likely need to be first established in Consumer Health before it takes on more specific direction in Beauty and Personal Care. Although the women’s wellness space is in its infancy beauty brands are exploring how to position themselves in this space. Innovation in hair loss and hair thinning will continue to trend upward, as well as and increased presence of collagen by need states.

Learn more about the 2023 performance of the beauty and personal care industry in Euromonitor’s International report, World Market for Beauty and Personal Care, to identify opportunities and prospects in beauty by geography and category.

Conclusion

The future of cosmetics lies in the continued evolution of holistic approaches which represents a transformative shift in the industry, merging scientific advancements, natural ingredients, and wellness principles. By understanding and embracing the interconnectedness of these elements, the cosmetics industry can cultivate products that not only enhance external beauty but also contribute to the overall well-being of individuals and the planet.

The interplay between beauty from within and topical cosmetics is the key for future products. The integration of biotechnology and green chemistry is revolutionizing cosmetic formulations, offering sustainable and biocompatible alternatives.

Developers can implement blockchain to trace the journey of ingredients from source to product. Nevertheless, the efficacy of the natural products should be scientifically proven. Marketers can communicate transparency as a brand value, and parallelly educate consumers by highlighting how specific ingredients contribute to radiant and healthy skin.

By embracing the synergy between these approaches and leveraging scientific advancements, the cosmetics industry can provide consumers with comprehensive beauty solutions that cater to both internal and external dimensions of beauty.

References and notes

- §This article was originally written and published by Euromonitor International on 9 July 2024.