Column: SURFACTANTS INSIGHTS

EUDR - Europe's Dumbest Regulation

NEIL BURNS

Managing partner, Neil A Burns LLC

Neil Burns is managing partner of Neil A Burns LLC, an investment and advisory firm focused on the surfactant and oleochemicals industries. He holds a BSc. in Chemistry from the University of York, UK and an MBA from the Wharton School. He produces a series of conferences on the business of surfactants and authors the Surfactants Blog.

In our industry as in all others, regulations provide incentives (often negative, but incentives nonetheless) which then drive behavior of both companies and individuals. Many regulations, even though national or regional in scope, will drive behavior around the world. Here’s an example very close to home.

EUDR – four letters guaranteed to strike fear in the heart of many a surfactant industry participant. As most readers will know, the European Union Deforestation Regulation (EUDR) is a law designed to ensure that certain key products and their derivatives placed on or exported from the EU market do not contribute to deforestation or forest degradation anywhere in the world. The regulation covers commodities such as palm oil, soy, beef, coffee, cocoa, rubber, and timber, as well as some of their derivatives. Implementation has been delayed. For large and medium-sized companies and traders, the rules will apply on December 30, 2025. For micro and small enterprises, the rules will apply from June 30, 2026.

Despite the delay in implementation, there continue to be very significant loopholes in the regulation which threaten the future of large swathes of the European surfactant and oleochemicals industries. EU rule makers have been made aware of this but seem not to have responded to these valid and important concerns of many chemical companies.

Here’s what’s happening and what’s at stake.

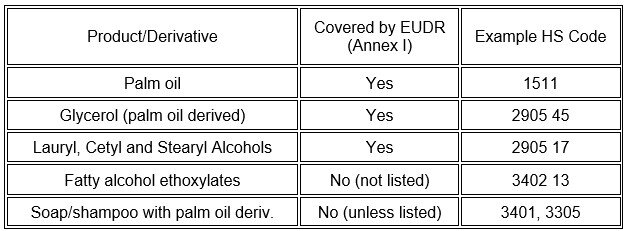

EUDR (Regulation (EU) 2023/1115) targets seven commodities and a number of derived products, as specifically listed in Annex I of the regulation (1). Only products and derivatives explicitly listed in Annex I are subject to EUDR. But there are loopholes. For example, while the EUDR covers certain palm oil derivatives (e.g., glycerol, fatty alcohols), many easily produced and transported downstream products such as fatty alcohol ethoxylates are not explicitly listed in Annex I by their tariff codes. The regulation covers palm oil (HS 1511), palm kernel oil (HS 1513), and some derivatives like glycerol (HS 2905 45), but does not explicitly include HS codes for fatty alcohol ethoxylates (typically HS 3402), even if these ethoxylates are derived from palm.

Below is an example of tariff code numbers that are ‘in scope’ and ‘not in scope’ for palm oil and some derivatives.

That’s not all. The same analysis applies to esters, including biodiesel, made from palm oil, as recently highlighted by the European Oleochemicals and Allied Products Group (APAG) and others (2).

As noted above EUDR covers palm, palm kernel oil and fatty alcohols. It also covers Palmitic acid, stearic acid, their salts and esters, Industrial fatty acids and acid oils from refining, and fatty alcohols. However, many palm-based esters, including fatty acid methyl esters (FAME, the main component of biodiesel), are not explicitly listed in Annex I by their typical HS codes (e.g., 3826 for FAME/biodiesel). Additionally, not included is HS Code 1516 which is for animal or vegetable fats and oils and their fractions, partly or wholly hydrogenated, inter-esterified, re-esterified or elaidinized, whether or not refined, but not further prepared.

Unless these obvious loopholes are closed (and it is very simple to do so), there is a very real and immediate prospect of the European market being overwhelmed by imports of nonionic surfactants and various esters from countries where oils and fats of uncertain and undocumented provenance are used in the production of derivatives not specified in the current draft of EUDR.

Readers familiar with surfactants will understand that palm kernel oil is easily converted to lauryl alcohol which in turn is easily ethoxylated to make AE-3, AE-7 or AE-9 which, at 100% active matter are as easily transported as any other bulk liquid. Therefore it is highly likely that the vast overcapacity in China for nonionic surfactants (recently reported at my surfactants conference in Malaysia in November 2024) will be directed toward Europe, where local producers, constrained by having to use only EUDR alcohols or palm kernel oil, will be unable to compete and will therefore disappear. The same scenario will play out in esters and biodiesel. This is surely an unfair disadvantage for Euroean Producers.

This disadvantage, likely to result in the loss of critical industries in the EU and many good-paying jobs, can be set right by literally a few taps on a keyboard. Doing so, though, requires admitting a mistake was made. Big deal. Human behavior responds to incentives. The incentives right now are leading to the inevitable destruction of much surfactant and related manufacturing in the EU. Someone needs to be incentivized to fix a regulation drafting error before the end of this year.