Sustainability

Skin care

peer-reviewed

Understanding and calculating Product

Carbon Footprint in Beauty

MORGANE EZANNO

Commercial Sustainability Lead, EMEA, Univar Solutions, Paris, France

ABSTRACT:

The chemical industry has a crucial role to play in the climate discussion. Indeed, it is one of the largest industries in the world: in 2022, its total worldwide revenue stood around 5.72 trillion U.S. dollars (1). The industrial sector generates more than 30% of global GHG emissions and petrochemical production accounts for approximately 8% of global industrial GHG emissions (2). As such, advances in chemical production can have a profound effect globally.

This article reviews the current regulatory context, brands and consumers expectations in the beauty and homecare markets, value chain emissions from raw materials, chemical manufacturing, and distribution. In addition, it highlights the connectedness and complexity of value chain greenhouse gas (GHG) emissions, and tools such as PCFs (product carbon footprints) that can be used throughout the value chain to reduce GHG emissions.

??????????????????

“

“A study in healthy women providing probiotic yogurt for four weeks showed an improvement in emotional responses as measured by brain scans”

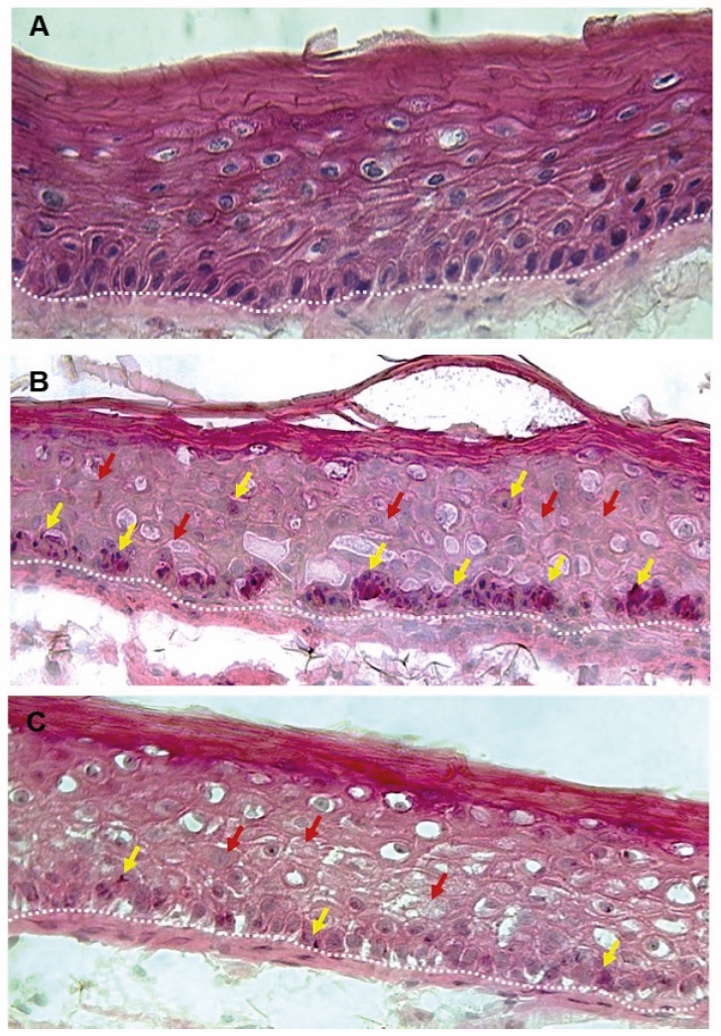

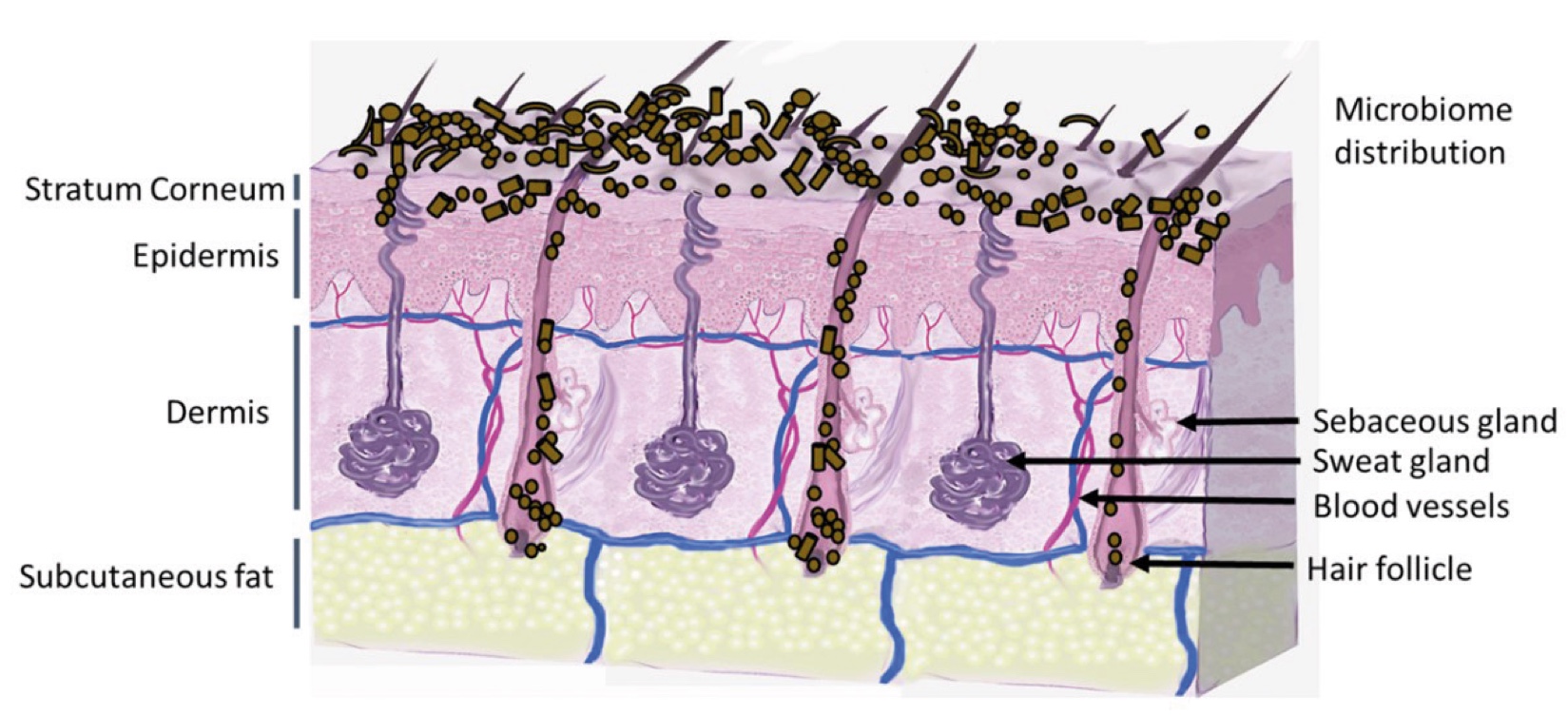

Figure 1. Skin Section with Microbiome. Most microorganisms live in the superficial layers of the stratum corneum and in the upper parts of the hair follicles. Some reside in the deeper areas of the hair follicles and are beyond the reach of ordinary disinfection procedures. There bacteria are a reservoir for recolonization after the surface bacteria are removed.

Materials and methods

Studies of major depressive disorder have been correlated with reduced Lactobacillus and Bifidobacteria and symptom severity has been correlated to changes in Firmicutes, Actinobacteria, and Bacteriodes. Gut microbiota that contain more butyrate producers have been correlated with improved quality of life (1).

A study in healthy women providing probiotic yogurt for four weeks showed an improvement in emotional responses as measured by brain scans (2). A subsequent study by Mohammadi et al. (3) investigated the impacts of probiotic yogurt and probiotic capsules over 6 weeks and found a significant improvement in depression-anxiety-stress scores in subjects taking the specific strains of probiotics contained in the yogurt or capsules. Other studies with probiotics have indicated improvements in depression scores, anxiety, postpartum depression and mood rating in an elderly population (4-7).

Other studies have indicated a benefit of probiotic supplementation in alleviating symptoms of stress. In particular, researchers have looked at stress in students as they prepared for exams, while also evaluating other health indicators such as flu and cold symptoms (1). In healthy people, there is an indication that probiotic supplementation may help to maintain memory function under conditions of acute stress.

Today, 193 countries have signed and committed to comply with the 17 UN Sustainable Development Goals (SDGs) (3). The European Union plans to be climate-neutral by 2050 – an economy with net-zero greenhouse gas emissions. This objective appears at the heart of the European Green Deal (4). As a key element of it, the European Corporate Sustainability Reporting Directive (CSRD) (5) entered into force in January 2023. It requires all large and listed companies in the EU to disclose their Scope 1, 2 and 3 emissions yearly. It revises and strengthens the sustainability reporting requirements, with the objective to put it on the same level as financial reporting. Companies are expected to be more accountable for their impacts on people and environment, to provide more relevant, comparable, reliable, easier to access data related to sustainability, and to realize more sustainable investments.

The transition to a climate-neutral society is an opportunity that every business is capable of embracing. In addition to new regulations, multiple stakeholders are adding pressure: 74% of consumers believe businesses have a responsibility to make society fairer, while 64% demand for climate action, saying it is businesses’ responsibility to solve climate and environmental issues (6). This appears especially true for younger cohorts, as sustainability represents a core part of who they are. However, today there is a value – action gap: 93% of people want to live a sustainable lifestyle, but only 10% are actively changing their behavior. Therefore, consumer-facing companies, for example in Personal Care, must understand how to close the value-action gap by providing consumer-demanded products and educating with respect to sustainability.

Many consumers are embracing sustainability and seeking ways to track, measure, and better understand their environmental impact, including how carbon reduction impacts their purchasing decisions (7). At the same time, numerous carbon advertisements confuse consumers: i.e., Carbon-neutral, Carbon-negative or positive, Carbon-free, Carbon-responsible… (8) and consumers cannot be confused if they are to be part of the solution. Without education and quantification based on science and consistently used by the entire value chain, it is challenging to know what products are “better” from a sustainability perspective.

From my experience working for an ingredient distributor, they are an essential part of the chemicals and ingredients value chain. This unique position between suppliers and customers requires significant collaboration and a key source of data in the value chain. Indeed, the suppliers‘ reach is extended in a sustainable way by ingredient distributors, offering products, formulations and services that align with sustainability requirements. They are increasingly used to support ESG objectives across the supply chain: add or replace chemicals and ingredients to improve sustainability in the finished products, use renewable energy for production, report GHG emissions and set targets... Conducting customer surveys on an annual basis allow to gather data on general sustainability questions. A survey conducted in 2022 received around 1,000 responses. In 2024, 61% of respondents reported ESG goals, up from 51% in 2022 (internal data). This survey also highlighted that more customers are requesting scope 3 and PCF data from their supply chain to more accurately report their own GHG emissions.

The number of PCF requests from ingredient distributor’s customers increases every year, as well as the number of customers sending sustainability questionnaires. In 2023, 24 customers requested PCFs for more than 2,000 products; in 2024, we provided more than 137 customers PCFs for over 4,350 products.

A product carbon footprint (PCF) is a measure of the climate impact of a product, in kg CO2-equivalents/kg product, commonly accounting for all processes from the point of raw material extraction to the point of customer receipt (i.e. “cradle-to-gate”). A cradle-to-gate PCF accounts for GHGs emitted during raw material extraction, processing, and transport, as well as treatment of related pre-consumer wastes. Per Together for Sustainability (TfS), cradle-to-gate PCFs exclude emissions related to transport to customer.

A major share of the industry’s greenhouse gas emissions arises from the upstream value chain, or upstream Scope 3 emissions. Currently, many corporations rely on generic data to estimate their scope 3 upstream emissions. While this is a great start, to reduce Scope 3 emissions, a company requires supplier specific PCF data to identify and target their emissions hotspots and product opportunities available for carbon reduction. However, the complexity of the global chemical sector value chain can make it difficult to compare and harmonize PCF calculations.

TfS created a chemical-industry-specific guideline for PCF calculation (9). These guidelines were created to align with International Standard ISO 14067 (10), the GHG Protocol Product Standard (11), the European Commission Product Environmental Footprint (PEF 2021) system (12), and the Pathfinder Framework (PACT powered by WBCSD) (13). Thanks to TfS’ PCF Calculation guideline, TfS members and supply chain partners can better understand the GHG emission impacts associated with the products they buy and sell.

Conclusion

The complexity of the chemical industry supply chain causes difficulty in gathering reliable and consistent sustainability data across the value chain. Beauty and Home Care customers must become part of the solution. Requesting PCFs from upstream suppliers will help to identify hotspots and carbon reduction opportunities and enable more accurate GHG emissions reporting. Partnering with suppliers and distributors that utilize TfS’ PCF Guideline will result in accurate carbon footprints. In addition, harmonized PCF calculations will build trust throughout the supply chain and ultimately lead to lower supply chain GHG emissions. Ingredient distribution has a key role to play on this journey. Working between suppliers and customers provides a unique perspective and enables to help customers reduce scope 3 GHG emissions.

Conclusion

The future of cosmetics lies in the continued evolution of holistic approaches which represents a transformative shift in the industry, merging scientific advancements, natural ingredients, and wellness principles. By understanding and embracing the interconnectedness of these elements, the cosmetics industry can cultivate products that not only enhance external beauty but also contribute to the overall well-being of individuals and the planet.

The interplay between beauty from within and topical cosmetics is the key for future products. The integration of biotechnology and green chemistry is revolutionizing cosmetic formulations, offering sustainable and biocompatible alternatives.

Developers can implement blockchain to trace the journey of ingredients from source to product. Nevertheless, the efficacy of the natural products should be scientifically proven. Marketers can communicate transparency as a brand value, and parallelly educate consumers by highlighting how specific ingredients contribute to radiant and healthy skin.

By embracing the synergy between these approaches and leveraging scientific advancements, the cosmetics industry can provide consumers with comprehensive beauty solutions that cater to both internal and external dimensions of beauty.

Surfactant Applications

The application area lends itself particularly well to the use of AI. Active today in this area is the US company Potion AI (6). The company provides AI-powered formulation tools for beauty and personal care R&D. Their offerings include Potion GPT, next generation ingredient and formula databases and AI document processing. Potion’s work could have a significant impact on the entire surfactant value chain, from raw material suppliers to end consumers. By using their GPT technology, they can help target work toward novel surfactant molecules that have optimal properties for specific applications. By using their ingredient and formula databases, they can access and analyze a vast amount of data on surfactant performance, safety, and sustainability. By using their AI document processing, they can extract and organize relevant information from patents, scientific papers, and regulatory documents. These capabilities could enable Potion AI's customers to design and optimize surfactant formulations that are more effective, eco-friendly, and cost-efficient. A particularly interesting application for this type of capability is deformulation.

Deformulation is the process of reverse engineering a product's formulation by identifying and quantifying its ingredients. Deformulation can be used for various purposes, such as quality control, competitive analysis, patent infringement, or product improvement. However, deformulation can be challenging, time-consuming, and costly, as it requires sophisticated analytical techniques, expert knowledge, and access to large databases of ingredients and formulas.

AI can potentially enhance and simplify the deformulation process by using data-driven methods to infer the composition and structure of a product from its properties and performance. For example, AI can use machine learning to learn the relationships between ingredients and their effects on the product's characteristics, such as color, texture, fragrance, stability, or efficacy. AI can also use natural language processing to extract and analyze information from various sources, such as labels, patents, literature, or online reviews, to identify the possible ingredients and their concentrations in a product.

Figure 2. Skin Section with Microbiome. Most microorganisms live in the superficial layers of the stratum corneum and in the upper parts of the hair follicles. Some reside in the deeper areas of the hair follicles and are beyond the reach of ordinary disinfection procedures. There bacteria are a reservoir for recolonization after the surface bacteria are removed.

References and notes

- Total revenue of the chemical industry worldwide from 2005 to 2022, Statista, 2024

- How to build a more climate-friendly chemical industry, World Economic Forum, 2020

- Sustainable Development Goals (SDGs), RELX SDG Resource Centre, 2025

- EU Action - Climate strategies & targets - 2050 long-term strategy, European Commission, 2025

- Corporate sustainability reporting, European Commission, 2025

- Kantar homepage, 2025

- The case for carbon reporting, Mintel, 2023

- Clearing the air on carbon reporting, Mintel, 2025

- The gold standard PCF Guideline is now complete, Together for Sustainability, 2022

- ISO 14067:2018 Greenhouse gases — Carbon footprint of products — Requirements and guidelines for quantification, ISO, 2024

- Product Life Cycle Accounting and Reporting Standard, Greenhouse Gas Protocol, 2025

- European Platform on LCA | EPLCA - Environmental Footprint, European Commission, 2025

- Pathfinder Framework Version 2.0, World Business Council for Sustainable Development, 2023